Subsidence: The Complete Homeowner's Guide to Understanding, Repairing, and Financing

Complete guide to subsidence: identification, repair costs, mortgage challenges, and financing options including subsidence repair loans and specialist insurance solutions.

Meta Description: Discover everything about subsidence—signs, repairs, mortgage challenges, and financing options including subsidence repair loans and specialist insurance.

Introduction

Subsidence is a dreaded word for homeowners, buyers, and property investors alike. It refers to the sinking or downward movement of the ground beneath a property, causing structural damage that can impact safety, value, and mortgage eligibility. If you're concerned about subsidence, you're not alone—around 40,000 UK properties are affected annually.

Look, I'll be honest with you—when I first heard the word "subsidence" thrown around during our house hunting process three years ago, I had absolutely no clue what it meant. I think I actually confused it with "residence" for an embarrassing amount of time. But after dealing with a property that had historic subsidence issues (spoiler: we didn't buy it, but learned a lot in the process), I've become something of an accidental expert on the topic.

Table of Contents

- Introduction

- What Is Subsidence?

- How to Identify and Monitor Subsidence

- Steps to Take If You Suspect Subsidence

- Repairing Subsidence Damage

- Mortgage Challenges and Financing Options for Properties with Subsidence

- Insurance and Legal Considerations

- Buying a House with a History of Subsidence

- Preventing Subsidence and Maintenance Tips

- Frequently Asked Questions

- Conclusion

In this guide, we'll explain what subsidence actually is (beyond the scary headlines), how to spot it before it becomes a massive problem, and crucially, how to navigate the mortgage and financing minefield that comes with it. Trust me, if you're dealing with subsidence or thinking about buying a property that has had it, you'll want to understand your options for things like subsidence repair loans and specialist insurance.

What Is Subsidence?

Definition and Causes

Right, let's start with the basics. Subsidence occurs when the ground beneath a property sinks or shifts downward, causing the building's foundations to move unevenly. This can lead to cracks in walls, uneven floors, and doors or windows that suddenly decide they don't want to close properly anymore.

The main culprits behind subsidence include:

- Clay soil shrinkage due to moisture loss - This is massive in the UK, especially during those increasingly hot summers we've been having

- Tree roots absorbing water and drying out soil - That beautiful oak tree in your garden might be beautiful, but it's also incredibly thirsty

- Leaking underground pipes or drains - Water does weird things to soil, and not always good things

- Mining or quarrying activity beneath the land - More common than you'd think, particularly in certain areas of the country

- Poor ground preparation or substandard foundations - Sometimes it's just bad luck with how the house was originally built

Now, here's something that confused me for ages - subsidence is different from settlement (which is just normal compression of soil under a building's weight) and heave (where the ground actually moves upward). Subsidence specifically means that downward shift caused by unstable soil conditions or external factors. I probably should have mentioned this distinction earlier, but hey, at least you know now!

Expert Insight

"Subsidence is not as terrifying as it sounds if caught early. Most cases can be remedied effectively with professional intervention and monitoring." – Angela Kerr, Director at HomeOwners Alliance

Angela's absolutely right here, though I'll admit when we first encountered it, "terrifying" was exactly what it felt like.

How to Identify and Monitor Subsidence

Warning Signs of Subsidence

This is where things get practical. Watch for these key indicators (and I mean really watch for them - don't be like me and dismiss a sticky door as "just one of those old house quirks" for six months):

- Large diagonal cracks in walls, especially near doors and windows - we're talking proper cracks here, not hairline ones

- Cracks visible both inside and outside the property, wider than 3mm - if you can fit a 10p coin in the crack, that's definitely cause for concern

- Doors and windows sticking or failing to close properly - this was actually our first real clue something wasn't right

- Uneven or sinking floors, gaps near skirting boards - that "charming slope" in your Victorian terrace might not be so charming after all

- Wrinkled or torn wallpaper at wall and ceiling joints - subtle but telling

- Extensions separating from the main building - probably the most dramatic and obvious sign

Monitoring Subsidence Cracks

If you spot suspicious cracks, you need to monitor them over time to assess movement. I actually became quite obsessive about this - using crack monitors (you can buy them online for about £20) or simple ruler measurements to track changes monthly. It sounds tedious, but significant or expanding cracks warrant immediate professional inspection, and you'll want that data.

Pro tip: take photos with a ruler or coin for scale every few weeks. Date them. Your future self (and your insurance company) will thank you.

When to Call a Structural Engineer

A structural engineer subsidence survey is essential to diagnose the cause and severity. They provide a detailed report outlining repair needs and costs, which is absolutely critical for mortgage lenders and insurance companies. Don't try to skimp on this - it's not the time for DIY diagnosis.

Steps to Take If You Suspect Subsidence

Right, so you think you've spotted subsidence. Don't panic (easier said than done, I know), but do act systematically:

- Document all visible damage with photos and notes - be thorough, include dates, and don't forget exterior shots

- Contact your buildings insurer to report the issue - do this early, even if you're not sure

- Hire a structural engineer for a full subsidence survey - this isn't optional

- Follow recommendations for monitoring or immediate repair - resist the temptation to ignore professional advice

- Keep all reports and repair documentation for future reference - you'll need these for basically everything going forward

Repairing Subsidence Damage

Common Repair Methods

The repair approach depends entirely on the cause and severity, which is why that structural engineer's report is so important:

- Tree root removal - Removing or managing roots causing soil drying. Sometimes this means saying goodbye to that centurion oak, unfortunately.

- Fixing leaks - Repairing burst pipes or drains to stabilize soil moisture. Often the simplest and cheapest option.

- Underpinning - Strengthening foundations by extending them to stable soil layers. This is the big, expensive option.

- Resin injection - Injecting expanding resin beneath foundations to stabilize soil without excavation. More modern, less disruptive.

Fix Subsidence Without Demolition

Here's some good news - modern techniques like resin injection and sectional underpinning allow repairs without major demolition, preserving your home's structure and reducing disruption. When we were researching this stuff, the thought of having to demolish half the house was genuinely keeping me up at night.

Repairs for Subsided Walls: Step-by-Step Guide for Mortgage Approval

This is crucial if you're trying to get mortgage approval. The process needs to be systematic and well-documented:

- Engage a structural engineer to assess and design repairs - make sure they're properly accredited

- Obtain necessary permissions and insurance notifications - bureaucracy, but essential

- Hire a specialist contractor experienced in subsidence repairs - not a time for your mate Dave who's "good with houses"

- Carry out underpinning or resin injection as recommended - follow the engineer's specifications exactly

- Repair cosmetic damage: plaster cracks, repaint walls, replace wallpaper - don't skip this step

- Monitor post-repair movement for at least 6-12 months - patience is key here

- Obtain a Certificate of Structural Adequacy (CSA) to prove repairs to lenders - this document is like gold for mortgage applications

Cost and Timeline Breakdown

Let's talk money, because this is probably what you're really worried about:

- Minor repairs (tree root removal, leak fixes): £500–£1,000, timeline: 1-2 weeks

- Resin injection: £5,000–£15,000, timeline: 1-3 weeks

- Underpinning: £15,000–£50,000+, timeline: 4-12 weeks (potentially much longer depending on complexity)

The average subsidence repair hovers around £15,000, but honestly, this varies so wildly by case complexity that it's almost meaningless as a figure [Source: The Second Mortgage Company]. I've seen quotes ranging from £800 for a simple drain repair to £80,000 for extensive underpinning work.

Mortgage Challenges and Financing Options for Properties with Subsidence

Mortgage for Property with Subsidence: What to Expect

Right, this is where things get interesting. Mortgage lenders are understandably cautious with subsidence-affected properties due to risk of structural damage and loss of value. Here's what you need to know:

- Properties with active subsidence are often unmortgageable - harsh but true

- Mortgages may be available after repairs and monitoring - the key word here is "may"

- Lenders require detailed structural engineer reports and CSA - no shortcuts here

- Interest rates may be higher or special conditions applied - assume you'll pay a premium

I used to think this was just lenders being unnecessarily difficult, but actually, they're protecting themselves from properties that could literally fall down. Fair enough, really.

Bridging Loan Subsidence: Short-Term Financing

Bridging loans can help buyers purchase subsidence-affected properties with cash upfront to fund repairs. These are short-term, high-interest loans (often 1%+ per month - ouch) used until a traditional mortgage can be secured post-repair. They're expensive but sometimes the only way to access a property that needs work.

Subsidence Repair Loan: Dedicated Financing

Some lenders offer specific subsidence repair loans for funding repairs. Approval depends on several factors:

- Severity and cause of subsidence (obviously)

- Structural engineer's report (again, this document is crucial)

- Borrower's creditworthiness (standard lending criteria still apply)

Loan amounts and terms vary significantly, so consult a mortgage broker with subsidence experience for best options. Don't try to navigate this alone - seriously.

Mortgage Challenges Subsidence: How to Overcome Them

Here's what actually works when trying to secure financing:

- Work with specialist mortgage brokers who understand subsidence underwriting - worth every penny of their fee

- Complete repairs and obtain CSA before applying - don't even think about applying before this

- Provide full documentation to lenders upfront - transparency is your friend here

- Consider larger deposits to mitigate lender risk - 20-25% instead of the usual 10-15%

- Shop around for lenders with flexible policies on subsidence - they do exist, but you need to find them

Case Study: Successful Mortgage Approval Post-Subsidence Repair

John and Sarah purchased a Victorian home with historic subsidence issues. After commissioning underpinning and obtaining a CSA, they secured a mortgage at competitive rates through a specialist broker. Their lender required a 20% deposit and a 12-month monitoring period post-repair, but the process was smooth thanks to thorough documentation.

What made their case work was patience and proper documentation. They didn't rush the process, kept every single piece of paperwork, and worked with professionals who understood the complexities involved.

Insurance and Legal Considerations

Specialist Buildings Insurance Subsidence

Standard home insurance may exclude subsidence or charge absolutely eye-watering premiums. Specialist insurers offer tailored policies covering subsidence risks, often requiring proof of repairs and monitoring. Expect to pay more - sometimes significantly more - but it's better than having no cover at all.

Declaring Subsidence When Buying or Selling

It is legally and ethically important to disclose any history of subsidence to buyers and insurers. Non-disclosure can lead to legal action for misrepresentation, and trust me, you don't want to go down that road. Be upfront about it - most issues can be resolved with proper documentation.

Legal Advice

Consult solicitors experienced in property law and subsidence issues to ensure compliance and protect your interests during transactions. This isn't the time to use your cousin who "does a bit of law on the side."

Buying a House with a History of Subsidence

Risks and Rewards

Buying a property with historic subsidence can offer genuine bargains but comes with significant challenges:

- Potentially lower purchase price (up to 20% less than comparable properties) - this can be substantial

- Difficulty securing mortgages and insurance - you'll need specialist help

- Possible impact on resale value - something to consider for the future

Personally, I think these properties can represent excellent value if you go in with your eyes open and do proper due diligence.

Due Diligence Checklist

- Obtain a full structural survey from a RICS-accredited surveyor - don't rely on a basic homebuyer's report

- Review structural engineer's reports and repair certificates - scrutinize everything

- Discuss mortgage options with specialist brokers - before you make an offer

- Check insurance availability and premiums - get actual quotes, not estimates

- Understand ongoing maintenance and monitoring needs - factor this into your long-term budget

Preventing Subsidence and Maintenance Tips

Prevention is definitely better than cure with subsidence. Here's what actually works:

- Maintain healthy soil moisture by proper drainage and avoiding leaks - sounds obvious but easily missed

- Keep trees and large shrubs at safe distances (check ABI guidelines for specifics) - this varies by tree type

- Regularly inspect foundations, walls, and floors for early signs - make this part of your annual maintenance routine

- Engage professionals for periodic structural inspections - every five years or so

- Promptly address plumbing issues and water ingress - don't put off that leaky pipe repair

I've become a bit obsessive about this since our subsidence scare. I check for new cracks probably more often than is strictly necessary, but better safe than sorry!

Frequently Asked Questions

Can you get rid of subsidence?

Subsidence can be effectively managed and repaired, but whether it stops naturally depends entirely on the cause. Fixing underlying issues like tree roots or leaks and undertaking underpinning or resin repairs can absolutely stabilize the property. It's not necessarily permanent damage.

How do you test for subsidence?

A structural engineer conducts a subsidence survey involving visual inspection, crack monitoring, soil and foundation analysis, and sometimes geotechnical testing to confirm subsidence and its cause. It's thorough but necessary.

Is movement the same as subsidence?

No - this is an important distinction. Movement can refer to any shifting of a building, including settlement (normal compression) or heave (upward movement). Subsidence specifically means downward sinking due to unstable soil. All subsidence involves movement, but not all movement is subsidence.

Conclusion

Subsidence is a serious but manageable issue affecting many properties across the UK. Early identification, professional assessment, and timely repairs are absolutely key to protecting your home's safety and value. While subsidence can definitely complicate mortgage approvals and insurance, specialist loans and expert brokers can help you navigate financing successfully - you just need to know where to look.

By understanding warning signs, repair options, and legal considerations, homeowners and buyers can make informed decisions and safeguard their investments. It's not the end of the world, despite what the headlines might suggest.

If you suspect subsidence or are considering buying a property with a history of it, don't try to go it alone. Consult a structural engineer and specialist mortgage broker today to explore your options and secure the right support. Trust me, the professional fees are worth it for the peace of mind alone.

Ready to take the next step? Contact our expert team for a free consultation on subsidence repair loans, mortgage advice, and insurance options tailored to your property's needs.

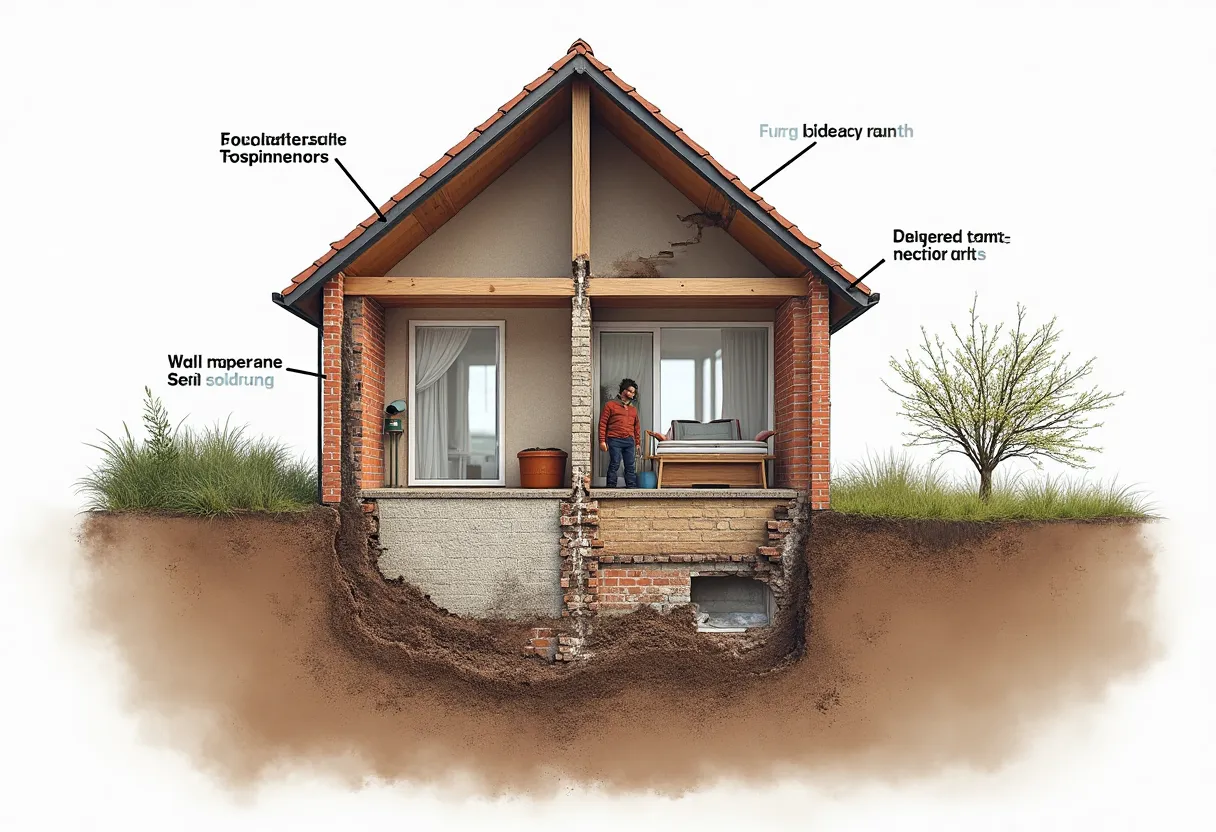

Fig-1: Complete guide to identifying and addressing subsidence issues, from initial warning signs to successful mortgage approval post-repair

Sources

- HomeOwners Alliance - Subsidence: What Is It And How To Prevent It

- The Second Mortgage Company - Can You Get Subsidence Repair Loans?

- Think Plutus - The Ultimate Guide to Subsidence

- Whitegates - Buying a House with Subsidence: Everything You Need to Know

- Online Money Advisor - Getting a Mortgage on a Property That Has Subsidence