Buying a House in Wales: A Real Guide for 2025 From Someone Who's Done It - 53

A genuine, no-nonsense guide to buying a house in Wales in 2025. Get real-world advice on mortgages, the South East Wales property market, and Help to Buy.

So, you’re thinking about buying a house in Wales. Good on you. It's an absolutely brilliant, terrifying, and ultimately rewarding thing to do. I remember when my wife and I bought our first place in Newport a few years back – the sheer amount of paperwork and acronyms (MIP, LTV, LTT... honestly) was enough to make your head spin. We muddled through, made a few mistakes, and learned a ton. Now we're in our second home, a bit further out, and I figured I'd write down everything I wish I'd known back then.

This isn't going to be one of those super-slick, corporate guides. This is the real-world version, the stuff you learn from actually doing it. We’ll talk about the money side of things, how the market *actually* feels on the ground (especially in South Wales, which is my patch), and the bits no one ever warns you about, like how long solicitors can take to answer a simple email. Let's get into it.

Table of Contents

- 1. So, What's the Welsh Property Market Actually Like in 2025?

- 2. The Step-by-Step Process (The Messy Reality)

- 3. The Costs They Don't Put on the Brochure

- 4. What If the 'Normal' Route Isn't for You?

- 5. Your Sanity Checklist and a Realistic Timeline

- 6. Some Questions I've Been Asked

- 7. A Few Final Thoughts

So, What's the Welsh Property Market Actually Like in 2025?

The View from the Ground

Alright, you'll see stats online saying the market is doing this or that. I saw something from Sage & Co Auctions saying transactions were up recently, which feels about right. [Source: Sage & Co Auctions] What I see around me, especially in the South East Wales property market, is that good houses in decent areas still get snapped up fast. The whole hybrid working thing has properly kicked in, so you've got more people looking for a bit more space, a garden, and good transport links back to Cardiff, Bristol, or even London.

This means areas around Newport, Caerphilly, and into Monmouthshire are pretty competitive. It creates a weird balance – prices have cooled off a bit from the post-lockdown madness, but there just aren't enough houses to go around. So don't expect to be low-balling offers and getting away with it everywhere. You need to be ready to move when you find the right place. I don’t know as much about West or North Wales, I’ll be honest, but the principles are the same – get a feel for the local demand before you get your heart set on anything.

How Fast Do Houses Really Sell?

Some reports say the average is 36 days on the market. [Source: Introducer Today] In my experience, that sounds... optimistic. I’ve seen houses go in a week, and I've seen some sit for months. The regular two and three-bed family homes seem to be the sweet spot. They fly off the shelves. Big, posh five-bedders and tiny one-bed flats can hang around a bit longer. It just depends what everyone else is looking for at the same time as you.

The Step-by-Step Process (The Messy Reality)

Step 1: The Money Talk (Getting Your Ducks in a Row)

Before you even *think* about looking on Rightmove, you need to sort your money out. This is the most boring part, but it's the foundation for everything. How much have you got for a deposit? The magic number is usually 10%, but you can get away with 5%, especially with schemes like Help to Buy Wales. We'll get to that. Just remember, the bigger your deposit, the better your mortgage rate will be, which saves you a fortune in the long run.

Also, don't forget the extra costs! We nearly got caught out. Things like solicitor fees, surveys, and the dreaded Land Transaction Tax. I’d say add at least another £5k to your savings goal just for those, to be safe. It’s always more than you think.

Step 2: The Dreaded Mortgage Application

Okay, this is where I'll get on my soapbox. Use a mortgage broker. Seriously. You can go direct to your bank, but a good, local mortgage broker in Wales knows the landscape. They have access to deals you don't and can package your application to make it look as good as possible. Pete Mugleston from Online Mortgage Advisor said it well, a bigger deposit gets you a better rate, and a broker helps navigate that. [Source: Online Mortgage Advisor]

The first proper step is getting a Mortgage in Principle (MIP) or an Agreement in Principle (AIP). It's a certificate from a lender saying what they'd *probably* lend you. It’s not a guarantee, but it shows sellers you’re not a time-waster. When we put the offer in on our current place, having that piece of paper made them take us more seriously than the other couple who were still 'thinking about their finances'. It gives you an edge.

Step 3: The Help to Buy Wales Scheme – Is It For You?

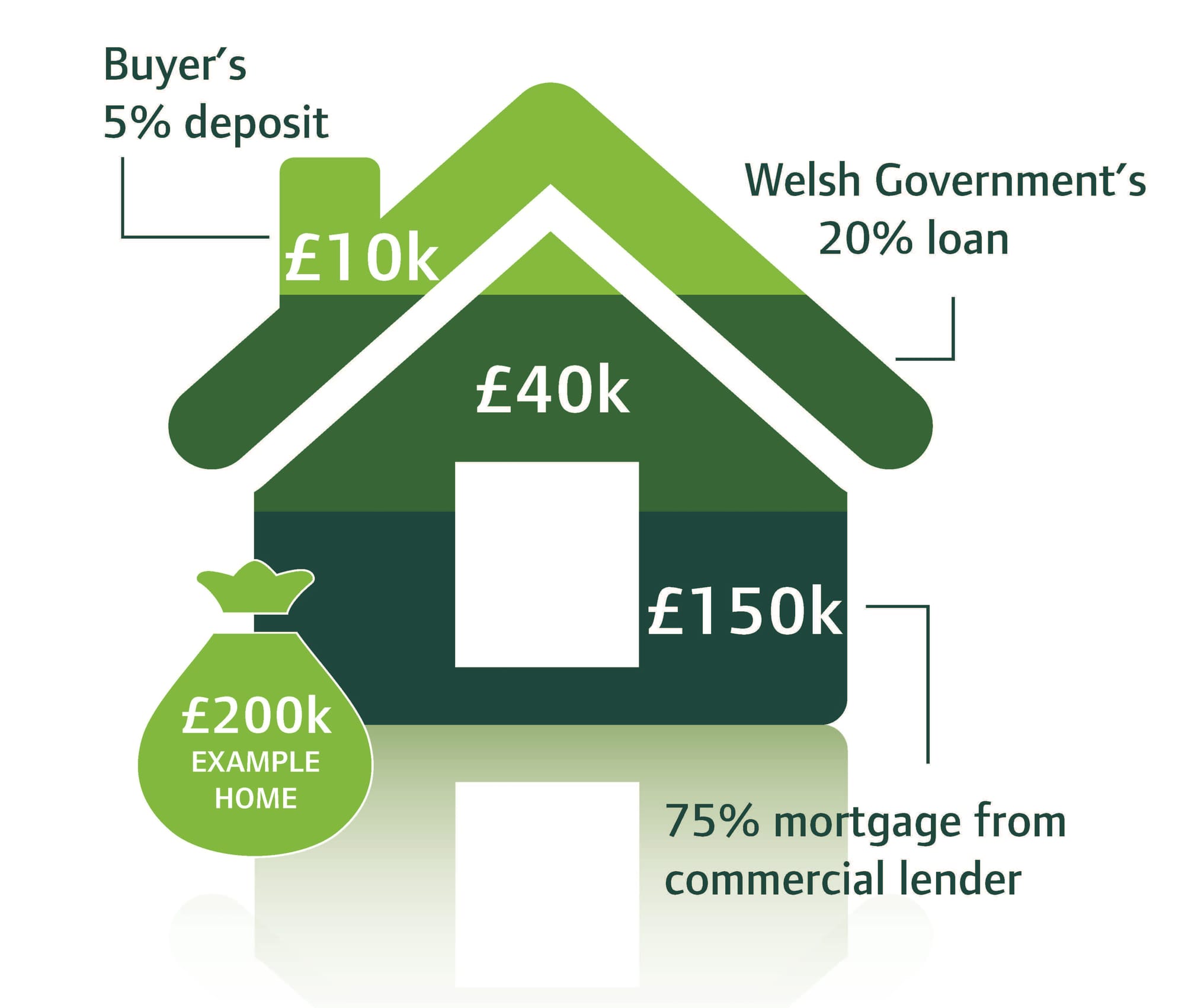

This scheme is a bit of a godsend for some people. It lets you buy a new-build home with just a 5% deposit. The government lends you up to 20% on top of that, interest-free for five years. Sounds great, right? And for many, it is. It gets you on the ladder when you otherwise couldn't.

But—and it's a big but—you have to remember that it's a loan, not free money. After five years, you start paying interest on it, and it has to be paid back when you sell. I used to be pretty skeptical about being tied to a new-build, but honestly, some of the new developments are really nice and you don't have to worry about surprise repairs. Just go in with your eyes open about that loan. It's a great tool, not a magic wand. Persimmon Homes has a good infographic that breaks it down visually. [Source: Persimmon Homes]

Fig-1: A simple breakdown of how the Help to Buy Wales scheme works. That 20% loan is the key part to understand.

Step 4: The Actual Fun Part (Finding a House)

This is it! Trawling websites, booking viewings, imagining your furniture in someone else's living room. A couple of tips from me: go to viewings at different times of day. A quiet street at 11am on a Tuesday can be a school-run nightmare at 3pm. And don't be afraid to ask nosy questions about the neighbours, the boiler, anything. When you make an offer, make it clear you have your mortgage in principle ready to go. It makes a difference.

Oh, and I should have mentioned earlier – prepare for disappointment. We fell in love with a perfect little terrace, offered the asking price, and got outbid by a cash buyer. It’s gutting, but it happens. Don't get too emotionally attached until the keys are in your hand.

Step 5: The Legal Mumbo-Jumbo (And Why You Shouldn't Skimp)

Once your offer is accepted, things get real. You need to instruct a solicitor or conveyancer. This is the person who does all the legal checks, the searches. My advice? Don't just go for the cheapest one your estate agent recommends. Ask around, read reviews. Our first solicitor was a black hole for emails. It was a nightmare. A good one is worth their weight in gold.

The other thing is the survey. I cannot stress this enough: GET A PROPER SURVEY. We got the most basic one for our first house and the surveyor missed some damp that cost us a fair bit to fix later. I was so annoyed at myself. For our second house, we paid for a full structural survey. It costs more, but the peace of mind is priceless. It's like a full health check for your biggest-ever purchase. Why would you skip it?

The Costs They Don't Put on the Brochure

I know I mentioned this, but it bears repeating. Your deposit is just the start. You're going to be hit with a bunch of other costs that really add up.

Remembering the Welsh 'Stamp Duty' (LTT)

In Wales, we don't have Stamp Duty, we have Land Transaction Tax (LTT). It works in bands, just like the English system, but the rates and thresholds are different. I think the thresholds have changed a bit since we last bought, so don’t quote me on the exact numbers, but you absolutely need to check the official gov.wales website and budget for it. It can be a nasty surprise if you haven’t accounted for a few thousand pounds.

All the Other Fees…

- Solicitor/conveyancing fees: Can be anywhere from £800 to £1,500+.

- Survey costs: A basic one might be £400, a full structural one can be over £1,000. Do the full one.

- Mortgage fees: Arrangement fees, booking fees... they all have different names but they all want your money.

- Removal costs: Unless you have a van and very good friends, this will cost you.

What If the 'Normal' Route Isn't for You?

It's not all about private sales. The old 'Right to Buy' scheme for council houses ended in Wales back in 2019, which was a blow for a lot of people. But there are still other ways. Some housing associations, like Wales & West Housing, have schemes like Low-Cost Home Ownership where you can buy a share of a property (say, 70%) and not pay rent on the rest. [Source: Wales & West Housing Association] I don't know the ins and outs personally, but it's definitely something to look into if you're struggling to afford 100% of a property on the open market.

Fig-2: This is a pretty typical view of the mix you get in the South East Wales property market. It's a great place to live, but competition is fierce.

Your Sanity Checklist and a Realistic Timeline

Before you start, get your paperwork in a folder: payslips (at least 3 months), bank statements (6 months), proof of ID, proof of deposit. It makes you feel organised, even when you're not.

As for how long it takes? Ha. How long is a piece of string? The articles say 12-16 weeks. For us, the first time was about 4 months from offer to keys. The second was closer to 5 because of a delay in the chain. Just be prepared to wait. It’s a marathon, not a sprint.

Some Questions I've Been Asked

Is 2025 a good time to buy?

Honestly, if you're financially ready and you find a house you love and can afford, any time is a good time. Don't try to 'time the market'. It's a fool's game. With rates finding their level and schemes like Help to Buy still running, it seems like a decent window of opportunity. [Source: Better.co.uk]

How much deposit do I *really* need?

As much as you can possibly scrape together. 5% is the absolute minimum to get a look-in with some lenders or the Help to Buy scheme. But if you can push for 10% or 15%, your monthly payments will be lower and you'll look like a much better bet to lenders.

A Few Final Thoughts

Look, buying a house is stressful. There will be days you want to give up and just rent forever. I get it. We had moments of pure panic. But as Jonathan Bone, a mortgage advisor, points out, getting local experts on board is key to navigating the Welsh system. [Source: Extend Finance]

When you finally get those keys and walk into *your* home for the first time, it's a feeling you can't beat. It's yours. You can paint the walls whatever ridiculous colour you want. It's all worth it. Mostly. Good luck, you've got this.

Sources

- Extend Finance - Buying a property in the UK. Guide to 2025

- Better.co.uk - The complete guide to buying a house in 2025

- Online Mortgage Advisor - How To Get A Mortgage In Wales

- Sage & Co Auctions - South East Wales Property Market 2025

- Persimmon Homes - Help to Buy - Wales

- Introducer Today - House sales speed up across England and Wales

- Wales & West Housing Association - Buying a home